Cell phones and the internet brought a considerable part of the developing world, including much of Africa, into the digital age and allowed many countries to bypass expensive landline and other infrastructure development. In many of these Global South countries, they are using technology to build a more inclusive financial sector and create entrepreneurial opportunities for their citizens including Port Of Harlem reader and Nigerian mobile banking agent Tony Izu.

“Agents have come to make banking easy in Nigeria and I am happy to be part of bringing banking services to un-banked Nigerians,” says Izu, a native of Imo, one of the 36 states in Nigeria. The Shared Agent Network Expansion Facilities (SANEF), an initiative of the Central Bank of Nigeria, has a goal of including 40 million low income, un-banked, and underserved Nigerians into the financial system.

Instead of building costly bank facilities across the country, SANEF provides an array of support services to accelerate the expansion of financial services to underserved communities largely through agents. The agents, like Izu, also accelerate the spreading of financial literacy.

Victor Olojo, national president of the Association of Mobile Money and Bank Agents in Nigeria (AMMBAN), says, “Looking back over the past five years that AMMBAN started, we are happy to say that we have witnessed meaningful gain in the industry.” According to Olojo, SANEF has recorded 700,000 mobile money and banking agents spread across the world’s most populous African nation.

Despite agent banking growth, Nigeria is still behind its peers in mobile money. “Ghana, Ivory Coast, and Senegal are doing much better,” says Akinwale Goodluck, Head of Global System for Mobile Communications in Sub-Saharan Africa, as reported in Business Day, Nigeria’s leader in business and financial news.

Goodluck reasons that Nigeria trails other countries because their system requires almost all of its customers to have a bank account. Kenya’s system, M-Pesa, is mobile money and enables users to pay for goods and services with their mobile phones, which serves as a wallet, without having to have a bank account. With mobile money, “your wallet sits on your phone. You are able to do your transactions without owning a proper bank account,” says Goodluck.

The Internet Expands Financial Opportunities in Global South Countries

Money

Since the mid-2000s, agent banking has emerged as a strategy to improve financial inclusion in many Global South countries. Brazil, which has the world’s second largest African population, has gotten much of the start-up credit.

However, the agent banking model caught on famously in Kenya. According to a 2019 report by the Central Bank of Kenya, 82.9% of Kenyans now have formal financial services, compared to just 26.7% in 2006. Poetically, many of the most important materials in phones and other electronics -- gold, tin, tantalum and tungsten -- come from mines in Congo.

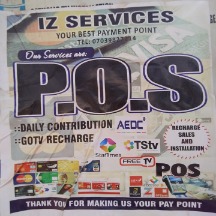

To start his now three-year-old business in Dei Dei, Abuja, the capital city, Izu needed N200,000 ($500). The point of sale (POS) equipment cost him an additional N25,000 ($60). He also had to become a partner with a financial institution or phone company.

Financial institutions and phone companies generally deputize the agents and it not unusual for an agent to serve multiple companies; Izu is affiliated with First Bank and Access Bank. For both banks, Izu through his company Izservices Ltd provides customers account openings, withdrawals, deposits, money transfers, billpaying, and mobile bill paying services from point of sale (POS) equipment.

Izu, who recently attended the AMMBAN annual conference, says that while the expansion has international implications, he takes the inclusion policies personally. “I am delighted to assist my community to reduce the stress of going to a bank and also reduce the spread of COVID since my customers don't need to line up at the bank to do simple transactions such as withdraw and send money.” Since the pandemic started, he has seen an increase in business.

He has also been able to develop his entrepreneurial skills. “I am able to employ one staff and pay monthly salary,” he says with pride.

However, the agent banking model caught on famously in Kenya. According to a 2019 report by the Central Bank of Kenya, 82.9% of Kenyans now have formal financial services, compared to just 26.7% in 2006. Poetically, many of the most important materials in phones and other electronics -- gold, tin, tantalum and tungsten -- come from mines in Congo.

To start his now three-year-old business in Dei Dei, Abuja, the capital city, Izu needed N200,000 ($500). The point of sale (POS) equipment cost him an additional N25,000 ($60). He also had to become a partner with a financial institution or phone company.

Financial institutions and phone companies generally deputize the agents and it not unusual for an agent to serve multiple companies; Izu is affiliated with First Bank and Access Bank. For both banks, Izu through his company Izservices Ltd provides customers account openings, withdrawals, deposits, money transfers, billpaying, and mobile bill paying services from point of sale (POS) equipment.

Izu, who recently attended the AMMBAN annual conference, says that while the expansion has international implications, he takes the inclusion policies personally. “I am delighted to assist my community to reduce the stress of going to a bank and also reduce the spread of COVID since my customers don't need to line up at the bank to do simple transactions such as withdraw and send money.” Since the pandemic started, he has seen an increase in business.

He has also been able to develop his entrepreneurial skills. “I am able to employ one staff and pay monthly salary,” he says with pride.

Advertisers | Contact Us | Events | Links | Media Kit | Our Company | Payments Pier

Press Room | Print Cover Stories Archives | Electronic Issues and Talk Radio Archives | Writer's Guidelines