On March 15, the Federal Open MarketCommittee (FOMC) voted almost unanimously to raise the federal funds rate by 0.25% - - to arange of 0.75% to 1%. This was the third increase since December 2008, when the benchmark rate was lowered to a near-zero level (0% o 0.25%) during the Great Recession.

The federal funds rate is the interest rate at which banks lend funds to each other overnight within the Federal Reserve system. It serves as a benchmark for many short-term rates set by banks. The March rate hike reflects the committee’s growing confidence in the health of the U.S. economy, but it’s also likely to push up borrowing costs for households and businesses.

The rate hike was widely anticipated by investors, and the only element of surprise was a change in the forecast for the federal funds rate. The current median projection for the end of 2017 is 1.4%, up from 1.1% forecasted in September 2016, which suggests that Fed officials expect three additional rate increases in 2017 instead of two.

As the financial markets priced in the prospect of an extra rate hike, the yield on two-year Treasuries surged to its highest level since August 2009. The 10-year Treasury yield climbed to 2.523%, the highest level in more than two years and a full percentage point higher than the record low in early July 2016. (Bond yields typically fall as Treasuries prices rise - - more on this later.) The S&P 500 index declined 0.8% on the day of the Fed’s decision, but recovered quickly and rose 0.4% the following day indicating that investors eventually seemed to be in agreement with the Fed's decision.

Considerations for Consumers

The prime rate, which commercial banks charge their best customers, is typically tied to the federal funds rate. Though actual rates can vary widely, small-business loans, adjustable rate mortgages, home equity lines of credit, auto loans, credit cards, and other forms of consumer credit are often linked to the prime rate, so the rates on these types of loans may increase with the federal funds rate. Fed rate hikes may also put some upward pressure on interest rates for new fixed rate home mortgages.

Although rising interest rates make it more expensive for consumers and businesses to borrow, retirees and others who seek income could eventually benefit from higher yields on the CD and savings accounts they own.

The FOMC expects economic conditions to “warrant only gradual increases,” but future Fed policies will depend on global financial developments, economic data, and growth projections. If inflation rises more or less than expected, rate adjustments will likely follow suit.

The financial markets could continue to react to Fed policies, but that doesn’t mean you should do the same. As always, it’s important to maintain a long-term perspective and make sound investment decisions based on your own financial goals, time horizon, and risk tolerance.

What About Investments?

When interest rates rise, the value of outstanding bonds typically falls. Longer-term bonds tend to fluctuate more than those with shorter maturities, because investors may be reluctant to tie up their money if they anticipate higher yields in the future. Bonds redeemed prior to maturity may be worth

March 16 – March 29, 2017

On The Dock This Issue:

Rising Rates: The Fed Takes Next Step Towards Normal

Although rising interest rates make it more expensive for consumers and businesses to borrow, retirees and others who seek income could eventually benefit from higher yields on the CD and savings accounts they own.

Although rising interest rates make it more expensive for consumers and businesses to borrow, retirees and others who seek income could eventually benefit from higher yields on the CD and savings accounts they own.

A Port Of Harlem Spring at the Alexandria Black History Museum

The Alexandria Black History Museum hosts a series of programs from the pages of Port Of Harlem magazine.

The Alexandria Black History Museum hosts a series of programs from the pages of Port Of Harlem magazine.

South Africa and Gambia Back in ICC

There are concerns that more African countries will leave the court given longstanding objections to the ICC's focus on the continent; specifically, that every person tried by the ICC has been African.

There are concerns that more African countries will leave the court given longstanding objections to the ICC's focus on the continent; specifically, that every person tried by the ICC has been African.

Don’t Mourn. Organize.

Videos that explain the health care controversies.

Videos that explain the health care controversies.

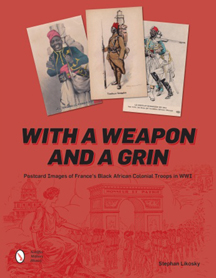

With a Weapon and a Grin

Via postcard images, the book explores the minds of some White people and provides an interesting view of how European powers used Black people.

Via postcard images, the book explores the minds of some White people and provides an interesting view of how European powers used Black people.

more or less than their original value, but if a bond is held to maturity, the owner suffers no loss of principal unless the issuer defaults.

Equities may also be affected by rising rates, though not as directly as bonds. Stock prices are closely tied to earnings growth, so many corporations stand to benefit from a more robust economy. On the other hand, companies that rely heavily on borrowing will likely face higher costs, which could affect their profits.

Again, it’s important to maintain a long-term perspective and make sound investment decisions based on your own financial goals, time horizon, and risk tolerance.

Central Bank Influence

The Federal Reserve and the FOMC operate under a dual mandate to conduct monetary policies that foster maximum employment and price stability. Adjusting the federal funds rate is one way the central bank can influence short-term interest rates, economic growth, and inflation. The Fed has been tasked with loosening monetary policy early enough to keep inflation from flaring up, but not so quickly as to reverse economic progress or upset financial markets.

Second Time Around

A lot has happened since December 2015, when the stock market cheered the Fed’s first rate increase since the financial crisis. At the time, the Fed projected four rate hikes by the end of 2016, but tightening was put on hold when gross domestic product (GDP) growth (or growth in the size of the economy) and inflation were slow to materialize. A number of outside risks, including a weak global economy and uncertainty surrounding the June Brexit vote, threatened to dampen U.S. GDP growth in the first half of 2016.

The Fed’s most recent statement acknowledged that “the labor market has continued to strengthen and that economic activity has been expanding at a moderate pace since midyear.” Unemployment fell to 4.6% in November, a nine-year low, and GDP growth improved to 3.5% in the third quarter.

Inflation is still below the Fed’s 2% target, but has started to firm up in recent months. According to the Fed’s preferred measure, personal consumption expenditures (PCE), prices rose at a 1.4% annual rate through October, and core PCE (which excludes volatile food and energy prices) rose at a 1.7% rate.

Again, it’s important to maintain a long-term perspective and make sound investment decisions based on your own financial goals, time horizon, and risk tolerance.

Abrams on TV: “Watch Financial Empowerment with Nick Abrams” in Washington, DC on DCTV and in Atlanta on People TV Atlanta, and YouTube. On the show, Abrams interviews experts on various financial topics.

Nicolas T. Abrams, CFP®, Investment Advisor Representative. Securities and investment advisory services offered solely through Ameritas Investment Corp. (AIC). Member FINRA/SPIC. AIC and AJW Financial Partners, LLC are not affiliated. Additional products and services may be available through Nicolas T. Abrams, CFP® or AJW Financial Partners, LLC that are not offered through AIC.

Equities may also be affected by rising rates, though not as directly as bonds. Stock prices are closely tied to earnings growth, so many corporations stand to benefit from a more robust economy. On the other hand, companies that rely heavily on borrowing will likely face higher costs, which could affect their profits.

Again, it’s important to maintain a long-term perspective and make sound investment decisions based on your own financial goals, time horizon, and risk tolerance.

Central Bank Influence

The Federal Reserve and the FOMC operate under a dual mandate to conduct monetary policies that foster maximum employment and price stability. Adjusting the federal funds rate is one way the central bank can influence short-term interest rates, economic growth, and inflation. The Fed has been tasked with loosening monetary policy early enough to keep inflation from flaring up, but not so quickly as to reverse economic progress or upset financial markets.

Second Time Around

A lot has happened since December 2015, when the stock market cheered the Fed’s first rate increase since the financial crisis. At the time, the Fed projected four rate hikes by the end of 2016, but tightening was put on hold when gross domestic product (GDP) growth (or growth in the size of the economy) and inflation were slow to materialize. A number of outside risks, including a weak global economy and uncertainty surrounding the June Brexit vote, threatened to dampen U.S. GDP growth in the first half of 2016.

The Fed’s most recent statement acknowledged that “the labor market has continued to strengthen and that economic activity has been expanding at a moderate pace since midyear.” Unemployment fell to 4.6% in November, a nine-year low, and GDP growth improved to 3.5% in the third quarter.

Inflation is still below the Fed’s 2% target, but has started to firm up in recent months. According to the Fed’s preferred measure, personal consumption expenditures (PCE), prices rose at a 1.4% annual rate through October, and core PCE (which excludes volatile food and energy prices) rose at a 1.7% rate.

Again, it’s important to maintain a long-term perspective and make sound investment decisions based on your own financial goals, time horizon, and risk tolerance.

Abrams on TV: “Watch Financial Empowerment with Nick Abrams” in Washington, DC on DCTV and in Atlanta on People TV Atlanta, and YouTube. On the show, Abrams interviews experts on various financial topics.

Nicolas T. Abrams, CFP®, Investment Advisor Representative. Securities and investment advisory services offered solely through Ameritas Investment Corp. (AIC). Member FINRA/SPIC. AIC and AJW Financial Partners, LLC are not affiliated. Additional products and services may be available through Nicolas T. Abrams, CFP® or AJW Financial Partners, LLC that are not offered through AIC.

The Alexandria Black History Museum hosts a series of programs from the pages of Port Of Harlem magazine. All programs open with a 20-minute reception with light refreshments. Reservations are strongly encouraged. To reserve your seat, call the Museum at (703) 746-4356, or email Port Of Harlem events: reserve@portofharlem.net. The lineup includes:

Saturday, May 20, 11 a.m. – 1:00 p.m.

Lecture - Contemporary African Immigration - “Africans were not considered immigrants before the 1960s,” says Dr. Nemata Blyden. The George Washington University professor talks about the Africans who arrived in the United States after slavery ended in 1863. James Kwegyir Agyeman was one of them. Aggrey came from the Gold Coast (Ghana) in 1898 and became an influential member of the African Methodist Episcopal Church, taught at Livingston College, and co-founded Ghana’s Achimota, one the world’s most prestigious high schools.

Register | Free

Saturday, May 20, 11 a.m. – 1:00 p.m.

Lecture - Contemporary African Immigration - “Africans were not considered immigrants before the 1960s,” says Dr. Nemata Blyden. The George Washington University professor talks about the Africans who arrived in the United States after slavery ended in 1863. James Kwegyir Agyeman was one of them. Aggrey came from the Gold Coast (Ghana) in 1898 and became an influential member of the African Methodist Episcopal Church, taught at Livingston College, and co-founded Ghana’s Achimota, one the world’s most prestigious high schools.

Register | Free

Saturday, May 27, 11 a.m. – 1:00 p.m.

Lecture - Getting the Most of Your Vacation for Less with Bernadette Champion - African Americans are the largest heritage tourism demographic in the United States. Learn how to maximize your spending power, support Black owned businesses, and look beyond traditional itineraries to include: African and African American related history, internet deals, restrictions, exceptions, price, and the fine print. With 30 years of travel planning experience, the owner of Champion Services Travel will discuss what you should consider when planning your vacation.

Register |Free

Saturday, June 17, 11 a.m. – 1:00 p.m.

Discussion - Fatherless Daughter Reconciliation - project founder, journalist, and author Jonetta Rose Barras and discussion leaders share their stories about their loss due to father absence or parental abandonment and its harmful affects on their lives. They will encourage participants to join the discussion-in-the-round, seeking to effect self-reconciliation, greater self-appreciation, self-love, and forgiveness while diminishing potential violence against themselves and others. We encourage adults to bring their teenage children to the discussion. Co-sponsored by Esther Productions.

Register | Fee $5.00

All events are free except for the Fatherless Daughter Reconciliation discussion, which is $5 (plus Eventbrite fee of $1.27). Donations are encouraged to support future programming. Free street parking is available. The Alexandria Black History Museum is at 902 Wythe Street, Alexandria, Virginia 22314, five blocks from the Braddock Road Metro Station on the Yellow and Blue Lines. For more information, please call 703.746.4356.

Lecture - Getting the Most of Your Vacation for Less with Bernadette Champion - African Americans are the largest heritage tourism demographic in the United States. Learn how to maximize your spending power, support Black owned businesses, and look beyond traditional itineraries to include: African and African American related history, internet deals, restrictions, exceptions, price, and the fine print. With 30 years of travel planning experience, the owner of Champion Services Travel will discuss what you should consider when planning your vacation.

Register |Free

Saturday, June 17, 11 a.m. – 1:00 p.m.

Discussion - Fatherless Daughter Reconciliation - project founder, journalist, and author Jonetta Rose Barras and discussion leaders share their stories about their loss due to father absence or parental abandonment and its harmful affects on their lives. They will encourage participants to join the discussion-in-the-round, seeking to effect self-reconciliation, greater self-appreciation, self-love, and forgiveness while diminishing potential violence against themselves and others. We encourage adults to bring their teenage children to the discussion. Co-sponsored by Esther Productions.

Register | Fee $5.00

All events are free except for the Fatherless Daughter Reconciliation discussion, which is $5 (plus Eventbrite fee of $1.27). Donations are encouraged to support future programming. Free street parking is available. The Alexandria Black History Museum is at 902 Wythe Street, Alexandria, Virginia 22314, five blocks from the Braddock Road Metro Station on the Yellow and Blue Lines. For more information, please call 703.746.4356.

South Africa formally revoked its withdrawal from the International Criminal Court (ICC) after its High Court blocked the government's bid to pull out of the Hague-based war crimes tribunal reports Reuters. South African authorities has since been asked to appear at the ICC on April 7 over the country's failure to arrest Sudan President Omar Hassan al-Bashir during a visit to South Africa two years ago, the acting chief state law adviser said last week.

As reported in Port Of Harlem, Africans Say International Justice System is Rigged, the ICC cannot arrest individuals itself; it relies on countries who participate in the court to make arrests. The Associated Press noted there are concerns that more African countries will leave the court given longstanding objections to the ICC's focus on the continent; specifically, that every person tried by the ICC has been African.

As reported in Port Of Harlem, Africans Say International Justice System is Rigged, the ICC cannot arrest individuals itself; it relies on countries who participate in the court to make arrests. The Associated Press noted there are concerns that more African countries will leave the court given longstanding objections to the ICC's focus on the continent; specifically, that every person tried by the ICC has been African.

Pretoria announced its intention to leave the ICC in 2015 after the court criticized it for disregarding an order to arrest Al-Bashir, who is accused of genocide and war crimes. Bashir has denied the accusations.

Gambia's new President Adama Barrow said that the West African nation would remain in the ICC after Gambia’s former president withdraw from the ICC. Burundi, the first to pull out, has not altered its membership.

Gambia's new President Adama Barrow said that the West African nation would remain in the ICC after Gambia’s former president withdraw from the ICC. Burundi, the first to pull out, has not altered its membership.

Center for Global Policy Solution created a short animated video to illustrate the positive impact of the Affordable Care Act and educate people about the potential pitfalls of healthcare reform.

From the Washington Post( 4 1/2 minutes): ACA vs. AHCA: How the Republican plan stacks up against Obamacare

What's the real reason Republicans want to repeal Obamacare and substitute a fake replacement? Watch Robert Reich's 2-minute video, find out, and please share.

Send a quick email to Jeff Bezos, CEO of Amazon: jeff@amazon.com — Tell him to adopt a hate speech policy and to end his funding for Breitbart. If you are a Prime member, say so! They can’t afford to lose us.

TIME reports: Dutch Prime Minister Mark Rutte on Wednesday claimed a dominating parliamentary election victory over anti-Islam lawmaker Geert Wilders, who failed the year's first litmus test for populism in Europe.

Following Britain's vote to leave the European Union and Donald Trump's election as U.S. president, "the Netherlands said, 'Whoa!' to the wrong kind of populism," said Rutte, who is now poised for a third term as prime minister.

From the Washington Post( 4 1/2 minutes): ACA vs. AHCA: How the Republican plan stacks up against Obamacare

What's the real reason Republicans want to repeal Obamacare and substitute a fake replacement? Watch Robert Reich's 2-minute video, find out, and please share.

Send a quick email to Jeff Bezos, CEO of Amazon: jeff@amazon.com — Tell him to adopt a hate speech policy and to end his funding for Breitbart. If you are a Prime member, say so! They can’t afford to lose us.

TIME reports: Dutch Prime Minister Mark Rutte on Wednesday claimed a dominating parliamentary election victory over anti-Islam lawmaker Geert Wilders, who failed the year's first litmus test for populism in Europe.

Following Britain's vote to leave the European Union and Donald Trump's election as U.S. president, "the Netherlands said, 'Whoa!' to the wrong kind of populism," said Rutte, who is now poised for a third term as prime minister.

"Stakeouts to Save Our Health Care" from 7:30 a.m. to 7:30 p.m. this Thursday and Friday, March 16 and 17.You sign up now for a one-hour stakeout shift and help save the our health care? Enter your ZIP Code to search for an event near you.

As the country debates the merits of heightened immigration enforcement, a new survey of key research concludes that policies further restricting immigration are ineffective crime-control strategies. Immigration and Public Safety, a report released today by The Sentencing Project, finds that immigrants have lower criminality and make up just 6% of the U.S. prison population while comprising 7% of the total U.S. population.

As the country debates the merits of heightened immigration enforcement, a new survey of key research concludes that policies further restricting immigration are ineffective crime-control strategies. Immigration and Public Safety, a report released today by The Sentencing Project, finds that immigrants have lower criminality and make up just 6% of the U.S. prison population while comprising 7% of the total U.S. population.

It is not too often that I get very excited about a book, but I was very excited to get into my hands “With a Weapon and Grin.” The 128 page hardback, printed on quality glossy paper, is filled with postcard images as part of an in depth look into the propaganda depicting darker skinned African soldiers during WWI. The postcards mainly feature France’s Colonial Troops.

As expressed by the publisher, “In incorporating Black African soldiers on the European battleground in their war against the Germans in WWI, France needed to change the image of the African from that of savage to a loyal and courageous soldier, a non-threat to French citizenry. What emerged was the “Grand Enfant,” a child-like figure with a winning grin who nonetheless could be ruthless in pursuit of the Hun (a negative turn to describe a German). Meanwhile, German propaganda persisted in portraying the African as a cannibal, being unjustly deployed by France against the civilized European.”

Via postcard images, the book explores the minds of some White people and provides an interesting view of how European powers used Black people - - and still do. It also provided some contrasts between French and American employment of White supremacy. For example, one caption explained how France Troupes Noires were allowed to march in France on Bastille Day in 1919 whereas the United States would not let African-American soldiers participate.

As expressed by the publisher, “In incorporating Black African soldiers on the European battleground in their war against the Germans in WWI, France needed to change the image of the African from that of savage to a loyal and courageous soldier, a non-threat to French citizenry. What emerged was the “Grand Enfant,” a child-like figure with a winning grin who nonetheless could be ruthless in pursuit of the Hun (a negative turn to describe a German). Meanwhile, German propaganda persisted in portraying the African as a cannibal, being unjustly deployed by France against the civilized European.”

Via postcard images, the book explores the minds of some White people and provides an interesting view of how European powers used Black people - - and still do. It also provided some contrasts between French and American employment of White supremacy. For example, one caption explained how France Troupes Noires were allowed to march in France on Bastille Day in 1919 whereas the United States would not let African-American soldiers participate.

As a black memorabilia collector with an international interest, I found many of the explanations amusing, but sickening. For example, “to diffuse any hint of interracial sexual connections, the majority of postcards portray Black soldiers as vulnerable and dependent beside the White nurse . . . when comic scenes of flirtation exist he is likely to be transformed into a desexualize and childlike creature,” writes author Stephan Likosky.

The book’s general exploration of Europe’s relationship with Africans at wartime with other Europeans complement the story I wrote, “Hassoum Ceesay: Colonized Africans and WWII." However, I understand that not all history buffs will find this book fascinating, but many will find it a great complement to what is on their bookshelves.

Note: The National Black Memorabilia, Fine Art, & Collectible Show at the Montgomery County Fairgrounds in Gaithersburg, MD is Saturday, April 8 10a-7p and Sunday, April 9 10a-5p. Visit the Port Of Harlem booth while there.

The book’s general exploration of Europe’s relationship with Africans at wartime with other Europeans complement the story I wrote, “Hassoum Ceesay: Colonized Africans and WWII." However, I understand that not all history buffs will find this book fascinating, but many will find it a great complement to what is on their bookshelves.

Note: The National Black Memorabilia, Fine Art, & Collectible Show at the Montgomery County Fairgrounds in Gaithersburg, MD is Saturday, April 8 10a-7p and Sunday, April 9 10a-5p. Visit the Port Of Harlem booth while there.

Reach our readers with an ad in Port Of Harlem for as little as $40. Readers will see your ad in two issues of the magazine. We release a new issue of the magazine every other week via e-mail, Facebook, Pinterest, Twitter, and LinkedIn. For $125, you will get at least eight placements during the year.

We have additional advertisement packages where we place your ad in the magazine and on various pages on our web site. Those web pages include our home page.

We have additional advertisement packages where we place your ad in the magazine and on various pages on our web site. Those web pages include our home page.

Click our Advertiser’s page to see our current list of advertisers. On that page, readers will view your banner ad, which we will link to your web page.

We can help you craft your message at no extra cost. We can also help you create other promotional efforts such as ticket or item give-a-ways to grab more attention to your message.

For more information send us an email or call Wayne at 202-583-3438.

We can help you craft your message at no extra cost. We can also help you create other promotional efforts such as ticket or item give-a-ways to grab more attention to your message.

For more information send us an email or call Wayne at 202-583-3438.

Washington

Ankara Bazaar DC

African-inspired pop-ups

918 F St, NW

Sa Mar 18, 1p-9p, $

Daley's Destinations presents Palace Resorts

Flavors of India

7185 Columbia Gateway Drive, Suite A

Columbia, MD

Thu, Mar 23, 6:30p-8p, free, dinner included

RSVP required (10 person limit),

443-676-5739

Global Mission Society

Benefit Gospel Concert & Fashion Show

Featuring The Sensational Nightingales

Food-Vendors-and more

Canterbury Hall

3125 Ritchie Road

Forestville, MD

240-481-8196

Sat, Mar 25, 1p-4p

Donation: $40.00 (Lunch Buffet included)

Julee Dickerson-Thompson's

The Butterfly Trip Book Party

(a coloring book for all ages)

Renaissance Square Artist Housing

4307 Jefferson Street

Hyattsville, MD

Sat, March 25, 1p-5p, free

Building Houses Out of Chicken Legs: Black Women, Food, and Power

Author, Psyche Williams-Forson

The Alexandria Black History Museum

902 Wythe Street

Alexandria, Virginia

Sat, Mar 25, 11a-1p, free

Norfolk State University Tour

Wed, Apr 12, 6:30a-6:30p, free

Ankara Bazaar DC

African-inspired pop-ups

918 F St, NW

Sa Mar 18, 1p-9p, $

Daley's Destinations presents Palace Resorts

Flavors of India

7185 Columbia Gateway Drive, Suite A

Columbia, MD

Thu, Mar 23, 6:30p-8p, free, dinner included

RSVP required (10 person limit),

443-676-5739

Global Mission Society

Benefit Gospel Concert & Fashion Show

Featuring The Sensational Nightingales

Food-Vendors-and more

Canterbury Hall

3125 Ritchie Road

Forestville, MD

240-481-8196

Sat, Mar 25, 1p-4p

Donation: $40.00 (Lunch Buffet included)

Julee Dickerson-Thompson's

The Butterfly Trip Book Party

(a coloring book for all ages)

Renaissance Square Artist Housing

4307 Jefferson Street

Hyattsville, MD

Sat, March 25, 1p-5p, free

Building Houses Out of Chicken Legs: Black Women, Food, and Power

Author, Psyche Williams-Forson

The Alexandria Black History Museum

902 Wythe Street

Alexandria, Virginia

Sat, Mar 25, 11a-1p, free

Norfolk State University Tour

Wed, Apr 12, 6:30a-6:30p, free

Baltimore

Daley's Destinations presents

Palace Resorts

Flavors of India

7185 Columbia Gateway Drive, Suite A

Columbia, MD

Thu, Mar 23, 6:30p-8p, free, dinner included

RSVP required (10 person limit),

443-676-5739

Chicago/Gary

Gardening with Native Plants and Pollinators

Paul H. Douglas Center for Environmental Education

100 North Lake Street

Mar 18, 9:30a-3:30p, $35 includes lunch

New York

Charlie Wilson, Fantasia, and Johnny Gill

Barclay Center

Wed, Mar 29, 7:30p, $

Spirits of Rebellion: Black Cinema from UCLA

Tisch School of the Arts

NYU-Dept. of Cinema Studies

721 Broadway

6th floor Michelson Theater

Tue, Mar 28, 6p, free

Coming

Baltimore Beard and Barber EXpo 2017

Baltimore NaturalhairCareExpo 2017

Baltimore Skin and make up Expo

Baltimore Cannabis Education Workshops

Coppin State University

Sat, Apr 1-Sun, Apr2, 11a-7p, $25-$50

National Black Memorabilia, Fine Art, & Collectible Show

Montgomery County Fairgrounds

I-270 South, Exit 11

Gaithersburg, MD

Sat, Apr 8 10a-7p-Sun, Apr 9 10a-5p, $

Daley's Destinations presents

Palace Resorts

Flavors of India

7185 Columbia Gateway Drive, Suite A

Columbia, MD

Thu, Mar 23, 6:30p-8p, free, dinner included

RSVP required (10 person limit),

443-676-5739

Chicago/Gary

Gardening with Native Plants and Pollinators

Paul H. Douglas Center for Environmental Education

100 North Lake Street

Mar 18, 9:30a-3:30p, $35 includes lunch

New York

Charlie Wilson, Fantasia, and Johnny Gill

Barclay Center

Wed, Mar 29, 7:30p, $

Spirits of Rebellion: Black Cinema from UCLA

Tisch School of the Arts

NYU-Dept. of Cinema Studies

721 Broadway

6th floor Michelson Theater

Tue, Mar 28, 6p, free

Coming

Baltimore Beard and Barber EXpo 2017

Baltimore NaturalhairCareExpo 2017

Baltimore Skin and make up Expo

Baltimore Cannabis Education Workshops

Coppin State University

Sat, Apr 1-Sun, Apr2, 11a-7p, $25-$50

National Black Memorabilia, Fine Art, & Collectible Show

Montgomery County Fairgrounds

I-270 South, Exit 11

Gaithersburg, MD

Sat, Apr 8 10a-7p-Sun, Apr 9 10a-5p, $

Advertisers | Contact Us | Events | Links | Media Kit | Our Company | Payments Pier

Press Room | Print Cover Stories Archives | Electronic Issues and Talk Radio Archives | Writer's Guidelines